Blog Posts

How will Brexit impact UK tech start-ups? Part 1

This is part 1 of a series of articles to explain how Brexit will affect UK based tech startups.

Having spent a lot of time in January digesting the finalised Brexit rules on behalf of our clients there are a few things we thought worth sharing more widely. This article focuses on UK SASS businesses providing digital services to other businesses

First, some good news. It’s quite likely that most B2B SAAS companies can ride their way through Brexit barely noticing it’s happened. The UK had been a huge influencer in the development of pan-EU VAT legislation. So in most cases, the rules for selling B2B services within the EU rules mirror the rules that otherwise apply in the UK for international sales.

In fact, life will be a little easier as there’s no longer a need to provide HMRC with an EC Sales List every calendar quarter.

There are, however, a few nasty little edge cases that will have an impact if you’re selling to businesses within Financial Services, Construction (or other industries where your customers make VAT exempt sales).

First the good news:

There may be cases where your product becomes 20% cheaper to UK customers.

Then the bad:

Your EU business customers may end up having to pay two lots of VAT (neither of which they can reclaim).

These edge cases come about because of a tricky bit of VAT legislation known as the “use and enjoyment override”. This rule doesn’t apply to most businesses, it was specially crafted for a specific set of industries. Unfortunately, this includes all SAAS businesses.

What is the “use and enjoyment override”?

For industries “caught” by this rule it’s not sufficient to know where the company buying your service is based. You need to also keep track of where they are using it, and it’s this location that counts for VAT purposes.

For a typical SAAS business, this means:

- Getting your customers to tell you this (e.g. when taking out their subscription), and:

- Making reasonable efforts to double-check, such as logging and monitoring the IP’s being used to log in.

Why does Brexit change things?

While we were part of the EU, the “use and enjoyment override” didn’t apply to sales made to other EU countries. This provision was removed when we left the EU, and HMRC will now insist that “use and enjoyment” rules are followed for all international sales.

Many UK SAAS companies begin their international growth by selling to EU countries. This means a lot of early-stage businesses will be exposed to a rule they were previously shielded from.

Even if you were already exposed to this rule (e.g. because you sell to the US or Canada), it’s now a bigger problem as the EU has much stricter rules around VAT owed by external countries selling to EU countries.

How can this make my product 20% cheaper?

It’s an edge case, but one with real-world examples. A few different factors need to come together:

- You’re supplying a UK company that makes VAT exempt supplies. This is common in financial services and construction. It means these companies are blocked from reclaiming some or all of the VAT on purchases they make.

- Your product is used by an EU branch of this company. For example, you’ve provided some sales automation only used by an EU based sales team. Or production management software used in their Polish factory.

From a UK perspective, the “use and enjoyment override” means you no longer charge your customer UK VAT. This is good news for them, as they can’t reclaim it (or at best can only reclaim some of it).

The fun comes because many EU countries apply the “use and enjoyment override” differently to the UK. Crucially, many don’t include SAAS companies in its’ scope.

In this situation, there’s no need for them to pay VAT in the country they are using your product, creating a net 20% saving to them.

Why is this a problem when I’m selling to EU companies?

The problem is almost the reverse of the above scenario. Let’s suppose you’ve grown to the point where you have operations in different countries. Now suppose you’re French branch is supplying another French company, but your product is being used by their UK branch.

Just like in the above scenario, your customer operates in an industry that is exempt VAT.

As France doesn’t include SAAS companies in it’s “use and enjoyment override” your French branch must charge French VAT.

Because the UK does include SAAS businesses, you must also tell them to reverse charge for UK VAT.

The result is a double charge of VAT, neither of which they can reclaim.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting, and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control, and tax structuring, and outsourced finance operations.

Whether you’re an early-stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15-minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.

The three best ways to hook up with investors (and what not to do)

Most tech businesses will raise equity funding at some point in their scale-up journey. One of the most common questions we get asked is how to find investors and pitch to them.

Here are our top tips on what to do, and what not to do.

#1 Look inside your target industry

The angel investment and VC industry want you to think that they’re your best or only option. They have a massive vested interest in you and spend heavily on clever content marketing.

If you’re an early stage start-up, your investors are investing based on two things:

- How much potential they see in your concept.

- How much potential they see in your founding team.

The best companies you can approach are those that know you. The next best people will be those who know the problem that your product seeks to eliminate.

Your professional network

Usually the concept your working on is in a field where you have professional experience. Reach out to as many former managers and colleagues as you can and let them know what you’re up to. They’ll get your concept and they’ll know what you’re capable of. So they’ll be happy to give a warm introduction to senior management or investment teams.

Industry events

Attend niche events for your target industry. Speak to as many people as you can and be passionate about what you’re doing and why. Even if you don’t find an investor, you may find a customer. At a minimum, you’ll have some great conversations that help you validate and refine your concept.

Customers

If you’re post-revenue, consider approaching customers about investing. This strategy works best if your product is sold mid-market or at enterprise level. These customers have capital and may even have their own corporate finance teams.

It’s likely you’ve spent time working with them to install and integrate your product. So, they know you and have a vested interest in your success. What’s more, the opportunity to influence your feature roadmap may be really appealing.

Some of our most successful clients have met all their early funding needs this way.

An analogous approach, for B2C businesses, would be equity crowdfunding. Pitching your crowdfunding at existing or ideal clients is an excellent strategy. They’re far more likely to buy into your pitch. You can sweeten the deal by offering “insider” access, such as greater input to your product roadmap or exclusive discounts.

#2 Community counts

The next best strategy is to find a friendly tech founder who’s a few steps ahead of you on their scale-up journey.

Angels and VC’s often use their existing investments to find their next opportunities.

Investors have confidence in founders they’ve already invested in. They know they have great commercial instincts. And they know they keep their finger on the pulse of the tech world.

Attend as many tech meetups as you can. They’re a great opportunity to meet other founders. And, the setting makes it easy to strike up a conversation.

It may take time to get that golden introduction, so you need to start this process early. However, you’ll meet some great people along the way. You’ll benefit from their insights and advice. And, you’ll keep your own tech knowledge fresh.

#3 Investor networking events

If you’ve tried both of the above, but haven’t had any luck, the next best opportunities are investor networking events.

Do not go down this route until you’ve already tried both of the above alternatives. This option may seem more direct, quicker, less effort, but it has its disadvantages. Always keep in mind that:

- The better events are pay-to-pitch. The more you pay the better the quality of investors you’re getting access to.

- It’s not only the ticket price you pay. Investment sourced at these events will likely be at a lower price per share than you’ll get from a warm introduction. First impressions count. At these events, it’s hard to stand out from the crowd.

- Go to free events and you’ll be meeting the predatory bottom of the industry.

To get the most out of them, practice your elevator pitch until perfect. Prepare to be challenged on two fronts:

- You need facts about what the company has achieved. What they care about is evidence you have traction – via sales growth or pre-orders.

- You need facts about what you’ve achieved as founders. Be ready to sell yourself. You’ll need a strong track-record at other start-ups. Or, you’ll need an impressive CV showing senior roles at large companies.

Finding events is easy. You’ll find plenty of opportunities via Eventbrite, Meetup.com, or similar sites. If you based in or around London, get in touch and we can recommend a few events that our clients have found useful.

… what not to do

Don’t get a bad rep

The investor community is small and tight-knit. Angel Investors and VC’s hate:

- Unsolicited direct approaches.

- Approaches from pre MVP founders who are far too early in their development.

- Having their time wasted by founders who haven’t prepared their pitch well enough.

- Overconfidence, unrealistic claims, and unsubstantiated claims.

These guys get pitched at hundreds of times a month. It’s mostly by underprepared founders with poor or unclear investment cases. This isn’t a numbers game, scattergun approaches don’t work. If you do any of the above, word will get around and you’ll soon find yourself blacklisted.

Don’t get conned

Always be cautious about who you’re talking to. Unfortunately, you’ll meet potential investors who aren’t who they claim to be. There are “funding advisors” that masquerade as potential investors to build a relationship with you. Once they’ve broken the ice, you’ll discover they have no money to invest. What they want is free equity in return for introductions.

Now, there are genuine funding advisors out there. But, because they’re good at what they do, they’ll never resort to deception to sell their services.

Good funding advisors are well networked and can introduce you to high-quality investors. They’re skillful at making connections that fit well. If you can’t reach those investors any other way, this may be a win-win relationship. But, keep in mind that advisors who are this well-networked will be expensive.

If you do bring in a funding advisor, make sure you have a watertight contract in place. This should set out:

- What type of investor you’re looking for. Based on objective criteria. So that you don’t waste money paying for introductions that aren’t useful to you.

- Clear (and reasonable) obligations on you to engage with investors in good faith. You don’t want to be coerced into following through on a bad offer. Or end up paying the introducer the full success fee so that you can walk away from negotiations.

Always try and negotiate a fee weighted towards a completed investment, and away from initial intros.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting, and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control and tax structuring, and outsourced finance operations.

Whether you’re an early stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15-minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.

Five ways tech start-ups can maximise their runway

Managing your runway doesn’t have the instant gratification of winning new business. It doesn’t provide the intellectual challenge of developing new tech. Yet:

- If you manage your runway poorly, your business will not make it through scale-up.

- If you manage your runway well, it will have a massive impact on your long term wealth as a founder.

Managing your runway is as critical to your success as having the right idea and the right market.

#1 Be really clear on your next milestone

When the topic of runway management comes up, too many tech founders focus on cash. Remember that your runway is there to help your business take off.

You have to be clear about what your next business milestone is. When it comes to managing your runway, this is either;

- Securing your next funding round, or;

- Becoming cashflow positive.

All other goals or objectives must be part of an overarching plan that achieves one of those two things.

#2 Be strategic and realistic

As every good project manager knows, cash is not the only variable in project planning. You also have control over scope, time, and quality.

No matter how good you are at fundraising, the brutal reality is that tech start-ups and scale-ups never have as much cash as they want.

To maximise the runway you have, you must be strategic with those other three variables.

Scope

Make sure the features you plan to release are realistic given the cash you have. Ensure you have enough buffer in case your estimates are off.

When selecting the features to include, you have to be brutally commercial. Rank features on how they’ll help you attract, convert, and retain paying customers. Drop vanity projects.

Time

Is there an urgent need to get new features to market? If not, consider buying yourself more time by bringing in other income. This is especially effective if you don’t currently have investors.

A lot of your development work is routine. It doesn’t need the technical skills and experience of your founding team. Can you sell your time to bring in much needed consulting income? Then use this income to outsource or delegate routine work at a lower cost? If you can, then you can create time.

Quality

Code quality and strong development practices are important. Compromising them will do long term harm. But, code quality alone won’t pay the bills.

Sometimes, you’ll need to strike a balance. You might need to compromise on code quality so that you can get features out. Then refactor once you’ve got new funding in place, or once you’ve made it out of scale-up and are net cash generative.

#3 Spend money …

One of the biggest mistakes some tech businesses make is to cut back too hard on expenditure. It’s a natural instinct, you’re worried about running out of cash. So it feels right to extend your runway by minimising your burndown.

However, The runway analogy is there for a reason. The last thing a pilot would do when taking off is slow the plane down.

If you don’t spend, you don’t grow.

The danger is that you’ll cut back on things you need to spend money on to reach your next milestone. Meanwhile, you’ll have fixed costs that you can’t eliminate. The result is that you reduce you cash burndown, but your development burndown plummets. Although you feel like you’ve gained a few months extra runway, you’ve increased the time you need by far more.

#4 … but spend it on things that matter

The answer is to focus your expenditure on the things that matter. Be ruthless in evaluating every item of expenditure on how it helps you get to your next milestone.

Saving £100/month on development software is a bad decision if it makes your £10,000/month dev team 5% less efficient.

Spending £10k to outsourcing dev work that you’ve never done yourself but always wanted to learn may be the smart move. If it’ll take time to learn, and you’ll never need to do it again, that £10k is money well spent.

Instead, give up your cool co-working space. This’ll free up the cash you need to pay for the outsourcing and the software tools. It may feel painful, but it will be worth it.

Jeff Bezos built Amazon out of a converted garage in a rented home. He built his own desk using a reclaimed door and some four-by-four. His electrical supply couldn’t handle his computer and heater simultaneously. So he worked in the cold.

This is someone who’d quit a lucrative Wall Street job. He was used to luxury. But, he backed his vision and did whatever it took to make his savings last.

Always ask yourself “what’s the return on investment?”. Eliminate all vanity expenditure. Be a miser when it comes to anything that doesn’t get you to your next milestone. By doing so you’re not slowing the plane down, you’re making it lighter.

Spend (invest) as much as you can on the things that have a positive ROI.

#5 Build a longer runway

You need to be ultra disciplined in your cash flow management:

Tweak your pricing model and marketing so that customers are paying you upfront. You’ll have to give a discount for upfront or annual payment. It’ll feel wrong to reduce your turnover like this. But if this discount is lower than your cost of capital, you will be better off.

Do everything you can to avoid paying upfront for software and services. Negotiate payment terms, or at least pay month-by-month. You’ll pay more. But, unless your supplier is another start-up, the extra cost will be lower than your cost of capital.

It may feel a bit uncomfortable. It may be a chore. But extending your runway by a few months may mean you get that killer feature finished. And that feature may have a huge impact on your price per share in your next investment round. Or, it may get you cashflow positive without having to sell any more of your business.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control and tax structuring and outsourced finance operations.

Whether you’re an early stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15 minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.

Three pricing models that tech businesses need to know

Setting the price for your product is one of the most important decisions a tech business can make. Your pricing strategy will make or break your scaleup journey.

There are two elements to your pricing strategy:

- Finding the pricing model that best suits your product and your commercial goals.

- Calibrating your model to find your optimal selling price.

This article looks at step 1. We’ll look at the three fundamental pricing models and examples of how you can implement them.

(If you’re interested in step 2, download a free copy of our book – it explains how to calibrate a Freemium pricing model).

#1 Maximisation

Maximisation is about generating as much revenue as possible, as fast as possible. How you do this depends on what you’re selling.

B2C SaaS businesses. You must be selling a premium product targeted at high net worth consumers. There is no alternative.

B2B SaaS businesses. Your product must be targeted at mid-market or enterprise level businesses. They need to be able to afford to pay and your product has to be sophisticated. Your ideal clients don’t just pay to use your product. They pay for consulting projects to implement what you’ve built, and tailor it to their workflows. And they keep on paying for high end support.

You’re dealing with a small number of sales, so you negotiate for the highest possible price each time. You’re not pushing product; your pricing is value based and unique to each client.

Marketplaces and e-commerce. A maximisation requires dynamic pricing. Think of how airlines, or Uber, measure supply and demand and recalibrate pricing in real time.

The challenges

#1 You need credibility. The founding team must have worked with clients matching your ideal customer avatar. And, you must have demonstrable experience solving the problem your product now addresses.

#2 You need resources. Maximisation strategies only work if you can afford to implement them:

- The bar for your MVP is set much higher. Mid-value and enterprise businesses won’t accept a minimal initial feature set. It doesn’t matter how impressive your roadmap is. Consumers will expect a luxury product, expect to invest heavily in UX.

- You’re selling high value products at enterprise level. This needs founders with experience in building a sophisticated sales operation. Even then, you’ll need to be able to afford to hire a sales team from day one. Or, be happy to outsource on a profit share basis.

- You need to build brand presence fast. You need a lot of cash to invest in the branding assets you need, and to get them seen. It’ll take time, and you need to be able to afford to wait for sales income.

#3 You need connections. Tech businesses that pull off maximisation are well networked with their ideal customers. The advantage of getting a leg up from a former manager is huge. You need resources, so you need a strong network of potential investors. Or, the skills to quickly build those connections.

The opportunity

To decide if this strategy is right for you, you need to examine your personal goals as founders. It’s almost impossible to implement this model without external help. This may be an outsourced sales partnership. It may be bringing in pre-MVP early investors. Either way, you need to be comfortable with:

- Giving up a large share of long-term profits and wealth.

- Sharing control over a large part of your business strategy.

If you are comfortable with this, then it’s a great strategy. You might have a smaller slice but it’s a much larger cake you’re sharing.

#2 Penetration

A penetration strategy focusses on winning a dominant market share. It’s by far the most common strategy adopted by SaaS businesses.

There are various models you can adopt. Each uses low pricing to reduce customer friction and grow user base quickly. Most of the models are so common they don’t need me to describe them to you:

- The Freemium model, by far the most common approach.

- Free consumer product supported by ad revenue.

- Extended free trial periods.

- Discounted pricing.

The real reason why most tech businesses fail

Despite their popularity, our experience is that most SaaS businesses sleepwalk into them. They see them as an easy way to start out, and that they can pivot later. It’s often a terminal mistake.

Firstly, they assume these techniques work well with a limited budget for sales and marketing. It must be easy to give something away for free, right? Unfortunately, the reality is that users are saturated with free products.

Even if it’s a great product, and even if you’re giving it for free, you still need a substantial advertising budget. Otherwise, users won’t know you exist.

Most SaaS start-ups fail by misunderstanding this and running out of cash before they’ve built any traction.

Secondly, changing your strategy is hard. If you train your users to expect things for free, it’s really hard to make them pay. The more features you give for free, the harder it is to charge for premium. This is where most SaaS scale-ups fail. Even though you’ve built traction, your investors lose patience. You run out of time before you find a path to profit.

The secret to pulling it off

The solution is to see penetration as a long-term game. Your product must have one or both of these advantages:

That your product improves with scale. For most businesses, this means leveraging economies of scale. For tech businesses, this is rarely relevant. Servers and data are cheap, and they don’t get much cheaper at scale. Your product needs to harvest user data. Either to build a better product, e.g. via machine learning or a network effect. Or, to sell targeted advertising.

That your product has high switching costs. This usually, again, means taking a predatory approach to your users’ data. This time, it’s by making it difficult for them to migrate it.

Equally important is having the right mindset. The pathway to profit involves using your users. It requires founders who have a hard commercial edge.

If you’re willing to do what it takes, these are the pricing models that make you the next tech unicorn.

#3 Skimming

A skimming strategy means you start with a high price. Then, you broaden your product so you can address more of the market at lower prices.

This strategy isn’t seen much in software. In the tech world, you see it in consumer hardware. Think of how Apple leads with premium products, before repackaging older tech at lower prices.

However, there are examples of software businesses that have adopted similar strategies. They start with high-end professional products, before broadening out into mid-market and consumer offerings. Adobe, Oracle, and Workday have all pulled this off.

Another example is tech consultancies that pivot to a hybrid business model. By developing internal tools, they work more efficiently, allowing them to deliver consulting services at lower price points. Then, with further development, they can take the same tool to market as an external product. This lets them access further customers with a lightweight support model.

From an investor’s perspective, the SaaS start-up and scale-up market is saturated. Coupled with a post-Covid tightening in investor appetite, you need to work hard to stand out.

One way of doing this is by not being yet another pitch centered on a penetration strategy. A well thought out plan based on skimming will certainly differentiate you.

… Putting it into practice

Your pricing model needs to be explicit. You need to decide which strategy is right for you, then align your entire sales, marketing, product, and tech engineering around it.

The best way to do this is for the founding team to collectively agree on what’s more important. Is it revenue growth, volume growth, profit generation, or market share?

Once you’ve decided this, you know which model is right for you. Then it’s just a case of adapting it around your product.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control and tax structuring and outsourced finance operations.

Whether you’re an early stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15 minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.

What do investors look for in a tech startup?

Most successful tech businesses will raise equity finance in their scale-up journey. Usually, they’ll have several funding rounds.

If you find the right investor you get the cash you need to accelerate your growth. The equity you give up is small relative to the extra business value you’ll create.

You also get a new business partner that’s aligned to your goals. Even better, they have experience helping tech businesses grow. You gain skills and a formidable network that your bootstrapping competitors can’t access.

Of course, it doesn’t always work out like this. The wrong investor will insist you ringfence their cash and use it in a way that best suits them. They expect more equity than you think is fair. Worse, they want more control over your business than their share holding warrants. They provide the skills you’re looking for via salaried advisors that you need to pay for.

The trick is to make yourself as attractive as possible to investors. Show you have these seven qualities and you’ll become an Investment Magnet. You’ll attract the right type of investors and never feel pressured to accept a bad fit.

#1 Solving real customer problems

Investors are attracted to tech businesses that solve real customer problems. Everything else is secondary. The number one thing you need to do to attract investors is give them:

- A clear description of the problem your tech solves.

- Proof that customers are willing to pay to solve the problem.

- Proof that your tech solves the problem.

You must convince them of these three things in your initial introduction. If you do, the rest of this article is about increasing how much rather than if they’ll invest.

#2 Growth potential

You must have a compelling growth story. This means:

- Your product solves the problem of a large or growing market.

- You have a proven strategy to access that market.

- Competition isn’t a problem, no large dominant brands, or other well funded start-ups.

- Or, if competition is a problem, that your product is disruptive.

Managing your broader funding strategy and cashflow is critical here. Strong market research and a good marketing plan will get you so far, but they won’t differentiate you. Investors hear from hundreds of start-ups and scale-ups with a plan but no traction.

Savvy investors will be far more attracted to tech businesses with hard evidence. The only way to do this is by building traction in the marketplace.

For your first round, this means balancing your tech plans with the seed capital you have. You want to be post revenue (or at least post MVP) before your first raise.

For later rounds, it means managing your cashflow and being strategic in your product development. This means you can show maximum traction between raises.

It’s also important that the evidence you present is compelling. You need to have the right finance operations. And, they need to be providing you with the right performance analytics. Investors want to hear impressive numbers. But, they also want to understand, and see you understand, what’s driving that growth. The better your analysis the more they’ll trust you to replicate and extend it.

#3 Your passion as a founding team

Investors are investing in you as much as they are in your business. This is especially true while you’re still on your scale-up journey.

The stronger you can claim to be leaders in your field, the better.

But, they’ll expect to see more than tech smarts on a strong CV. They’ll want to see you have customer focus and that you have deep insights into your target market.

Above all, you’ll need to convince them you’re a cohesive unit where the whole is more than the sum of it’s parts.

You have to pitch yourselves not just your product. What makes your skills unique? How do your individual skillsets complement and reinforce each other? What are the major setbacks you’ve had, and how did you pull together and use your strengths to overcome them? How can you showcase your passion and creativity? How does the journey you’ve taken so far show your flexibility? How have you adapted to market changes?

#4 Sustainability

Investors taking on extraordinary risk investing in tech start-ups and scale-ups. They do it in the hope of extraordinary returns. Convincing them of your growth potential is only half the battle.

You need to convince them your product can generate sustained growth. To do this, you need to be clear about your structural advantage:

- How will you become more powerful with scale?

- How will you be difficult to copy?

#5 Having a credible financial plan

The type of investors you want to attract are those that specialise in what you do. Usually, this means they’ve built up their wealth the hard way. Fudged figures and exaggerated claims won’t wash. Nor will a plan that focusses on what you’ll achieve without the resources you’ll need.

They’ll spot any hole in your financials a mile off. You need a robust financial model that’s can output the following:

Forecast turnover and profit

These provide the hard numbers that spell out your growth potential. You need to explain your key inputs and assumptions. And, you need to show they’re reasonable based on your current traction. The clearer and more transparent you are, the more you’ll gain your prospect’s trust.

Forecast cashflow and balance sheet

These explain the resources you’ll need and when you need them. No matter how strong your growth potential, investors want to know:

- How, and when, this potential gets turned into cash.

- That you’re not going to run out of cash first.

- That you’re not forgetting about other liabilities. Tax, employee share schemes and the myriad of other costs that are difficult to model and easy to get wrong.

Most “DIY” financial models can’t, or don’t, extend beyond modelling P&L . This leaves your investor guessing about how realistic your plans are and harms your credibility.

Risk

To be taken seriously, you have to acknowledge the uncertainty in your assumptions.

The right model identifies the assumptions that have the greatest impact on business value. And, it measures their impact.

This won’t always be intuitive or obvious, especially to the potential investor. You need to do the analysis for them and present alternative forecasts showing a range of other scenarios.

If you demystify the risk they’re taking, they’ll expect less equity as compensation.

#6 Why them?

I usually get a blank look when I ask clients this. It’s easy to get wrapped up in the need for funding and in how to pitch your business. There are two dangers to this:

Firstly, investors want to work with founders who understand that investment is a synergy. It’s not enough to present a great business opportunity to them. They expect you to understand what they want from the relationship. This means doing your homework and tailoring your pitch to focus on why you’re such a great fit.

It also means making sure you’ve applied for and received advance assurance from HMRC that your investors will benefit from SEIS or EIS treatment on their investment. This isn’t a direct tax benefit to you, but it does create massive tax savings for them.

These tax savings are an important part of what makes you attractive as an investment opportunity. By taking this step, before or shortly after your initial conversations, you remove any uncertainty and signal that you take their needs seriously.

Secondly, you lose sight of the need to attract the right investors not the wrong ones. You need to step back and think about who your ideal investor avatar is. The clearer you are the more you’ll attract the right partner.

#7 Have no skeletons lurking in your closet

If you’ve ticked each of the above boxes, with a bit of luck, you’ll end up with an “agreement in principle” that suits you.

The final hurdle is to make it through the financial due diligence process. There are two hurdles that you’ll need to jump:

Inconsistencies and irregularities

Expect your investor to send a team of accountants that’ll make a detailed inspection of your financial records. They’ll be looking for any inconsistencies between what you’ve said about your business and what’s actually recorded in your accounts.

It’s likely your business has, so far, been flying below HMRC’s radar. Your investor’s accountants to be looking hard for any tax irregularities.

Don’t let some fudged bookkeeping, or guesswork in a VAT return trip you up. It’s essential that your finance operations are being managed by a safe pair of hands. Someone with the competence to keep you safe and experience in audit and investor due diligence.

Contingent liabilities

It’s common that you’ll have made your seed capital go further by taking on consulting work. Perhaps your ongoing business plan involves a hybrid business model, combining your tech product with consulting and implementation support.

Investors know there’s limited scalability in consulting work. They want to invest in your product only.

It’s not only that they don’t value the consulting business. They’re repelled by it. It introduces risk that you’ll make a mistake that you’re sued over. With them having to pick up some or all of the bill.

The solution lies in your corporate structure. Put your product and consulting businesses sit in separate corporate entities.

Done correctly, there’ll be group tax reliefs that mean you can continue to cross subsidise your early development out of consulting income. Then, when you have investors ready, they can buy equity in your product, without having to worry about your consulting work.

The sooner you can get your corporate structure right the better. Leave it too late and you’ll have a shock at the tax bill. You’ll also create delay and complication that may mean your investor walks away.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control and tax structuring and outsourced finance operations.

Whether you’re an early stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15 minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.

The three KPI’s that matter to tech businesses

If you are an ambitious tech business looking to scale, it’s vital that you have the data you need to make the right strategic choices. Tech businesses are too complex to rely on guesswork, instinct and luck. The key to scaling up successfully is to make data driven decisions. Here are the three key measurements that matter …

#1 Runway

Proactively managing your runway is the key differentiator between the 1% of tech businesses that manage to scale successfully and the 99% that die or stagnate while trying.

Those who manage their runway well have the time they need to make it to the next level. If they need to raise money to get there, they know how much and when. They put themselves on the front foot when hunting investors. They’re driven to maintain the development progress they need to get the product where it needs to be. They don’t chase growth at any cost, they know where they need to be and they make strategic investments to get there. They never lose sight of their operating margins. Every inch of their runway is used effectively.

Most of the discussion around runway focusses on measuring how much money you have, how quickly you’re burning through it and how long you have before it runs out.

However, it’s meaningless for a pilot to measure how much runway is in front of them unless they know how fast they’re travelling, how quickly they can accelerate and what their takeoff speed is.

The same applies to your business. A holistic analysis of your runway involves getting clarity on your next business milestone, analysing what you need to do to get there, and estimating what resource this will take.

The right analysis and reporting on your runway measures your burndown both in terms of:

- How quickly you’re making progress, and

- How quickly you’re depleting your resources.

The former means being disciplined and rigorous in measuring and analysing a whole range of non financial metrics that are important to achieving your next business milestone. For most, this will include quantifying how many developer hours or story points you’ve completed in the period.

The latter requires a similar amount of time and effort in preparing a detailed cashflow forecast and maintaining this on an ongoing basis.

Having done all of this you’re left with two very simple but potent metrics:

- The time you need is the resources required to reach your next milestone, divided by your rate of progress.

- The time you have is your cash divided by your rate of cash burndown.

The ultimate health check on your business is knowing whether the latter exceeds the former. If it does, you gain confidence that your busineses is on track. If it doesn’t, you have all of the underlying data and analysis you need to work out what changes you need to make to acheive your goals.

#2 Growth rate

Any post MVP tech business needs to be obsessed with growth. Without strong growth you’ll secure no investment. Even if you’ve made it out of scale-up there’s no such thing as a sustainable business in tech – you keep on growing or you get overtaken and see all of your progress churn away, leaving you with nothing to show for all that progress.

The right way to measure growth varies depending on whether you’re pre-revenue or post-revenue and whether your revenue model consists of paid subscriptions, commission / advertising or freemium.

However, here are the key components you need to consider:

Active users – user numbers are usually easy to gather but meaningless. You need a process to differentiate your active users. Those that are regularly using your product.

For a typical SaaS product this would be measure the number of users regularly logging in. For other revenue models it would be the number of page views or the number of website purchases.

If you’re pre-revenue, this may be the key metric for your business (a proxy for your future turnover). If you’re post-revenue it’s important to remember that this is just part of the picture. It tells you nothing about the value each user is bringing to your business. Used correctly, it’s a key analytic for decomposing and forecasting your turnover. Given too much focus it becomes a vanity metric and leads to poor strategic decision making.

Activation rate – your active users (or number of activations) divided by your total user number. Ideally, you’d also segment this between newly acquired users vs users that existed at the start of your reporting period.

For newly acquired users it’s a key diagnostic for ensuring your marketing efforts are attracting the right audience and that your message is resonating. For existing users, activation rate measures how useful your product is, how easy to use and accessible it is and the quality of your customer support.

DAU : MAU ratio – your Daily Active Users (DAU) are the number of unique active users (or user activations) on a given day. For a typical SaaS business this is the number of unique users who logged in today. Your Monthly Active Users (MAU) are the number of unique users who have engaged with (activated) your product in some way in the past month.

The DAU:MAU ratio measures how “sticky” your active users are. For an average SaaS company this will be somewhere between 10% and 20%, meaning that your average user will use your product between three and six times per month. If you consistently do better than this you’ll have investors beating your door down. If the ratio is below where you want it to be, you know you need to focus on developing more engaging features. Otherwise churn will become a huge problem for you.

Churn rate – It’s almost always easier and cheaper to retain a customer than acquire a new one. Minimising churn is often the key that unlocks your growth.

For most SaaS businesses churn is measured as the number of cancelled subscriptions. Other revenue models may instead need to measure the number of users that failed to make a repeat purchase, or a repeat click through to an affiliate link (e.g. in a 90-day window).

Your churn rate is then the ratio of churn to the number of customers (or active users) at the start of the period. Ideally this is segmented between customers that were already signed up at the start of the month (i.e. those that failed to renew) and customer that signed up during them month. The latter will usually be much higher than the former so to really understand your growth dynamics it’s better to separate them.

MRR – if you’re post revenue, MRR is the single most useful metric for analysing your turnover. For most SaaS companies it’s simply the total value of all your monthly subscriptions. If you have annual or lifetime subscriptions, you need to convert these by dividing the total contract value by the number of months and add them in too.

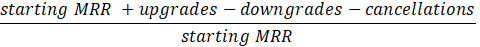

Net Revenue Retention Rate (NRR) – for a growing tech business, focussing on MRR isn’t enough. You’ll, hopefully, gain a warm fuzzy feeling seeing your MRR increase each period. But you’ll learn nothing about why it’s increasing and how you can make it increase faster. Your NRR measures your revenue growth from existing customers only:

By stripping out the impact of new subscriptions you get a clearer measure of how successful your product is. If it’s above 100%, you can be confident in your product-market fit, your pricing strategy and your customer service. If it’s below 100%, you have the tools you need to analyse what needs to be done to get your business on the path to sustainable growth.

#3 Profitability

The forgotten side of the triangle. We often find new clients overlooking their profitability. Runway keeps them up at night, while growth is seen as the panacea. However, all the runway in the world won’t save your business unless it can eventually turn a profit. No matter how fast you’re growing, eventually your investors will lose patience.

The key to scaling smarter is to place as much focus on your profitability (or your path to profit) as the other metrics. Here are the ingredients you need:

Customer Acquisition Cost (CAC) – measures the average total cost of acquiring a single customer.

Lifetime Value (LTV) – measures the total value that a single customer will generate, summed over all the months between them subscribing and unsubscribing. It’s calculated using the following formula:

Gross margin is the average percentage profit you make from a customer. ARPU is the average total revenue per customer. This is your MRR (from #2) divided by the number of active users.

LTV : CAC ratio – finally, you divide your LTV by your CAC. If this is greater than one you are ready to scale up. You’re making a unit profit per customer and a certain level of scale this profit will cover your overheads and future development costs.

If it’s less than one you’re not yet ready to scale. You need to invest time and resources working on:

- Improving your product / market fit.

- Finding a more efficient marketing strategy.

- Improving your revenue model.

- Fine tuning your pricing strategy

Your LTV : CAC ratio is the single metric that’ll measure the effectiveness of your changes.

… Make your data count

Finally, there’s no point in making a huge effort to measure complex KPI’s unless you can use them effectively to make better decisions.

To be useful, data has to be timely. Tech businesses are insanely fast moving. Unless you’re looking at current data you’re wasting your time. The KPI’s that matter aren’t easy to calculate and involve collecting a lot of data, both financial and non financial. It’s vital that you have a finance operation that’s experienced in turning around performance analytics quickly and efficiently.

To be useful, data has to be impactful. Tech businesses are also chaotic, with founders being pulled in many directions.

- You need data to be focussing on a small number of highly tailored metrics that get to the heart of what your business needs to do to scale.

- More than this, you need them to be presented by someone who’s an expert in analysing them and drawing out the key insights.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control and tax structuring and outsourced finance operations.

Whether you’re an early stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15 minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.

Employee Share Schemes, and other ways your finance scheme can help you attract and retain staff

Getting your finance strategy right will help you attract the talent you need, keep them longer and make them happier …

… a bold claim. I’ll be honest with you – my wife works in recruitment marketing and laughed out aloud when I made it. I convinced her, so I must be onto something.

Using your agility to maximise tax free employee benefits

Take advantage of the fact you’re small and agile. There’s a bunch of nice things you can do for your employees that, structured correctly, save you tax and don’t mean extra tax for them.

These are things you should be doing anyway, but the tax saving make it all the sweeter.

Maximising the effect of your workplace pension scheme

A bigger win comes from using your workplace pension scheme smartly. Workplace pensions will always save you and your employees tax. However there are big differences in how tax efficient you can be.

If you don’t optimise how you’ve set the scheme up, you could be missing out on an extra 25.8% that could be going into your valued employee’s pension at no cost to you or them.

The big one, share based payments:

These are very well known in the tech start-up and scale-up space, but more of a mystery to other owner managed business. If you’re not familiar with them:

What is share based payment?

It means giving employees a small shareholding in your business as well as their normal salary. Normally this is done by giving them share options that are linked to them meeting certain goals (e.g. over the next year). You can either give them the shares for free, or allow them to buy them (normally at a discounted price).

Why would I do this?

It’s normally done either instead of, or as an extra boost to, a cash bonus. So you use them to reward high performing staff:

- The obvious benefit is that it saves you money ?.

- But there’s more to it than this – the option structure encourages your key employees to stick with you (if they don’t the share options are worthless). Even once the options have “vested” (so they get given / can buy the discounted shares) they still want to stick around as they’re now part owners of your business.

- It motivates and aligns your best employees to your goals as the business owner.

- It does all of this very tax efficiently.

Giving away part of my business sounds scary

It’s right to be cautious, but if things are structured correctly any risks can be managed.

- The number of shares you use is kept small, so even if all your key employees meet their targets there’s no risk of you losing control of your business.

- The schemes are structured so that even if your relationships soured in the future, your past employees can’t get in your way. For example, you put conditions in place so that they can’t prevent you from selling your business by refusing to sell their shares.

Won’t this be more expensive than paying them, if my business takes off?

The short answer is yes, it may well be. The smart answer is that you’re better off with a slightly smaller share of a much bigger pie.

- The benefits (in terms of increased motivation and alignment) could well be the thing that helps your business take off.

- It’s better to get 90% of a £1m per year dividend than 100% of a £100k per year dividend.

- A well structured share scheme acts as a pair of “golden handcuffs” that keeps vital staff within your business. This actually makes your business more attractive to investors so they’ll pay more to buy your shares.

I don’t have employees but I do use subcontractors, does this work for them too?

Yes and no:

- Yes – if you have long term subcontractors, then giving them share options will have a similar impact as it would for employees. There are technical differences in how you’d structure things though, and it takes a lot more expertise to get meaningful tax benefits.

- No – if you’re using subcontractors on a short term basis then this may not be strategically optimal. It could be better to set up a joint venture or similar structure, where you both share equity in the JV, while you each retain ownership of your own businesses.

Permanent Establishments – and why they can be a problem for uk tech start-ups and scale-ups.

What is a permanent establishment?

Permanent Establishments are a feature of the international tax system. They allow a country to charge tax on revenues ? that have been generated there, even if that revenue comes from a multinational company that’s incorporated elsewhere.

You’ll still need to pay UK corporation tax, but there’s (usually) a tax treaty between the UK and the other country. The tax treaty (usually) ensures that one of the two countries refunds, or partly refunds, the tax you’ve paid in the other country.

However, you’ll have to deal with a lot of additional paperwork (and accounting fees). What’s more, if the tax due in the other country is higher than that in the UK you’ll usually pay the higher amount overall. Whereas, if the other country charges you less tax, you’ll not see that benefit – the total tax you’ll pay in that situation is usually the UK amount.

Why’s this a problem for tech start-ups and scale-ups?

Well, international tax law is complex and slow moving, whereas the tech industry in particular is very dynamic. Which is an accident waiting to happen ?.

The problem is that even very new tech start-ups can quickly be generating international revenue. No problem there …

… except that the tech industry is also a trailblazer at flexible and remote working. And increasingly this means looking for global solutions at finding the talent you need.

It’s this confluence that can find you getting unexpectedly caught up in the Permanent Establishment rules.

[meanwhile, those originally meant to be targeted ? spend a fraction of their swag ? on clever tax structuring].

So, what can be done about it?

If you’re aware of the problem there are plenty of things you can do to ensure you aren’t caught up in this unfairly. On the other hand, if creating a Permanent Establishment is what your business needs, it’s important to be on the front foot in managing the situation and making sure you’re using all the available tax reliefts. As with most things tax related, those steps can’t be applied retrospectively, so it’s important you’re getting the advice and support you need on an ongoing basis.

Budgetting is boring and pointless (and other myths)

Budgets…they’re boring…a waste of time…never pan out…they’re just for big corporates, not owner managed businesses…

Just some of the excuses I hear when I ask why budgeting doesn’t get the love❤️ it deserves. In fact, budgetting is one of the most powerful tools around for developing your business ideas and increasing the probability of turning your ideas into reality.

?? Budgets are boring

Is developing your business ideas and goals boring? Budgeting crystallises your thinking by forcing you to focus on and quantify the £ financial impact of your ideas. It moves your strategic planning from v1.0 to v.2.0

?? They’re a waste of time … and never pan out

Firstly, they aren’t supposed to be accurate. If you need absolute certainty in your life, you shouldn’t be a business owner.

However, if the exercise is too painful, or the results grossly inaccurate, that’s probably because you don’t have a solid grasp of your business’s financial mechanics. In that case you’re not wasting time, you’re investing it to deepen your understanding of your business.

How do you do this? By putting together a budget, even if it’s time consuming and you aren’t confident it’s robust enough, then monitoring how things actually turn out and analysing the variances. The lessons you learn during that analysis will be invaluable and lead to genuine insights into your business.

?? It’s just for big corporates

Budgets bring direction to your entire team, so you’re all pulling towards the same clear, unambiguous, goals. That’s just as true for a smaller owner managed business as it is for a FTSE 100 PLC.

If anything smaller businesses need that clear lodestar⭐️ more than a large corporate does. Growing a small business is tough, you’re buffetted by market forces far more than larger businesses, and, typically, founders have a 100 things on their to-do list that they aren’t experts in and don’t have anyone to delegate to.

Your budget helps provide clarity and focus about what you need to do to stay on track.

?? Convinced it’s worth the effort?

If I’ve changed your mind, and you want to give budgetting a try – here are two things you can do to create a better budget:

1. Check out my free guide to cashflow forecasting. Budgetting and forecasting are very similar activities, so a lot of the steps I outline there can be applied here.

2. Get in touch for a free strategy session. I’m always happy to discuss people’s business plans and give some tips about how to turn them into a fully fledged budget for the year ahead. Or, if it turns out we’re a good fit, you can always become a client and get much more substantive help!

Run your own race

One of the best things about being a business owner is the freedom to choose your own path.

But sometimes we lose site of this.

I was reminded of this a few weeks ago – a great client, who’d always impressed me with boundless positive energy, had seemed off his game the last few times we’d spoken.

I knew he’d started a family relatively recently, so it was easy to assume that sleepless nights on top of the general pressures of building a business was taking a toll.

But I’m glad I decided to check my assumption, because it was wrong. After a bit of gentle probing it was clear that what was actually going on was a more fundamental shift in his risk preference.

After spending a bit of time looking at his personal / family finances, as well as his business, we were able to plot a new course.

This one still get’s him the business he wants. It may take a bit longer, but he gets there in a way that suits him better now.