If you are an ambitious tech business looking to scale, it’s vital that you have the data you need to make the right strategic choices. Tech businesses are too complex to rely on guesswork, instinct and luck. The key to scaling up successfully is to make data driven decisions. Here are the three key measurements that matter …

#1 Runway

Proactively managing your runway is the key differentiator between the 1% of tech businesses that manage to scale successfully and the 99% that die or stagnate while trying.

Those who manage their runway well have the time they need to make it to the next level. If they need to raise money to get there, they know how much and when. They put themselves on the front foot when hunting investors. They’re driven to maintain the development progress they need to get the product where it needs to be. They don’t chase growth at any cost, they know where they need to be and they make strategic investments to get there. They never lose sight of their operating margins. Every inch of their runway is used effectively.

Most of the discussion around runway focusses on measuring how much money you have, how quickly you’re burning through it and how long you have before it runs out.

However, it’s meaningless for a pilot to measure how much runway is in front of them unless they know how fast they’re travelling, how quickly they can accelerate and what their takeoff speed is.

The same applies to your business. A holistic analysis of your runway involves getting clarity on your next business milestone, analysing what you need to do to get there, and estimating what resource this will take.

The right analysis and reporting on your runway measures your burndown both in terms of:

- How quickly you’re making progress, and

- How quickly you’re depleting your resources.

The former means being disciplined and rigorous in measuring and analysing a whole range of non financial metrics that are important to achieving your next business milestone. For most, this will include quantifying how many developer hours or story points you’ve completed in the period.

The latter requires a similar amount of time and effort in preparing a detailed cashflow forecast and maintaining this on an ongoing basis.

Having done all of this you’re left with two very simple but potent metrics:

- The time you need is the resources required to reach your next milestone, divided by your rate of progress.

- The time you have is your cash divided by your rate of cash burndown.

The ultimate health check on your business is knowing whether the latter exceeds the former. If it does, you gain confidence that your busineses is on track. If it doesn’t, you have all of the underlying data and analysis you need to work out what changes you need to make to acheive your goals.

#2 Growth rate

Any post MVP tech business needs to be obsessed with growth. Without strong growth you’ll secure no investment. Even if you’ve made it out of scale-up there’s no such thing as a sustainable business in tech – you keep on growing or you get overtaken and see all of your progress churn away, leaving you with nothing to show for all that progress.

The right way to measure growth varies depending on whether you’re pre-revenue or post-revenue and whether your revenue model consists of paid subscriptions, commission / advertising or freemium.

However, here are the key components you need to consider:

Active users – user numbers are usually easy to gather but meaningless. You need a process to differentiate your active users. Those that are regularly using your product.

For a typical SaaS product this would be measure the number of users regularly logging in. For other revenue models it would be the number of page views or the number of website purchases.

If you’re pre-revenue, this may be the key metric for your business (a proxy for your future turnover). If you’re post-revenue it’s important to remember that this is just part of the picture. It tells you nothing about the value each user is bringing to your business. Used correctly, it’s a key analytic for decomposing and forecasting your turnover. Given too much focus it becomes a vanity metric and leads to poor strategic decision making.

Activation rate – your active users (or number of activations) divided by your total user number. Ideally, you’d also segment this between newly acquired users vs users that existed at the start of your reporting period.

For newly acquired users it’s a key diagnostic for ensuring your marketing efforts are attracting the right audience and that your message is resonating. For existing users, activation rate measures how useful your product is, how easy to use and accessible it is and the quality of your customer support.

DAU : MAU ratio – your Daily Active Users (DAU) are the number of unique active users (or user activations) on a given day. For a typical SaaS business this is the number of unique users who logged in today. Your Monthly Active Users (MAU) are the number of unique users who have engaged with (activated) your product in some way in the past month.

The DAU:MAU ratio measures how “sticky” your active users are. For an average SaaS company this will be somewhere between 10% and 20%, meaning that your average user will use your product between three and six times per month. If you consistently do better than this you’ll have investors beating your door down. If the ratio is below where you want it to be, you know you need to focus on developing more engaging features. Otherwise churn will become a huge problem for you.

Churn rate – It’s almost always easier and cheaper to retain a customer than acquire a new one. Minimising churn is often the key that unlocks your growth.

For most SaaS businesses churn is measured as the number of cancelled subscriptions. Other revenue models may instead need to measure the number of users that failed to make a repeat purchase, or a repeat click through to an affiliate link (e.g. in a 90-day window).

Your churn rate is then the ratio of churn to the number of customers (or active users) at the start of the period. Ideally this is segmented between customers that were already signed up at the start of the month (i.e. those that failed to renew) and customer that signed up during them month. The latter will usually be much higher than the former so to really understand your growth dynamics it’s better to separate them.

MRR – if you’re post revenue, MRR is the single most useful metric for analysing your turnover. For most SaaS companies it’s simply the total value of all your monthly subscriptions. If you have annual or lifetime subscriptions, you need to convert these by dividing the total contract value by the number of months and add them in too.

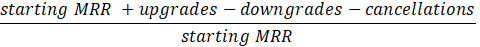

Net Revenue Retention Rate (NRR) – for a growing tech business, focussing on MRR isn’t enough. You’ll, hopefully, gain a warm fuzzy feeling seeing your MRR increase each period. But you’ll learn nothing about why it’s increasing and how you can make it increase faster. Your NRR measures your revenue growth from existing customers only:

By stripping out the impact of new subscriptions you get a clearer measure of how successful your product is. If it’s above 100%, you can be confident in your product-market fit, your pricing strategy and your customer service. If it’s below 100%, you have the tools you need to analyse what needs to be done to get your business on the path to sustainable growth.

#3 Profitability

The forgotten side of the triangle. We often find new clients overlooking their profitability. Runway keeps them up at night, while growth is seen as the panacea. However, all the runway in the world won’t save your business unless it can eventually turn a profit. No matter how fast you’re growing, eventually your investors will lose patience.

The key to scaling smarter is to place as much focus on your profitability (or your path to profit) as the other metrics. Here are the ingredients you need:

Customer Acquisition Cost (CAC) – measures the average total cost of acquiring a single customer.

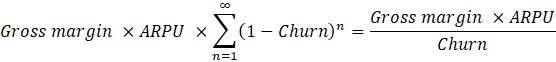

Lifetime Value (LTV) – measures the total value that a single customer will generate, summed over all the months between them subscribing and unsubscribing. It’s calculated using the following formula:

Gross margin is the average percentage profit you make from a customer. ARPU is the average total revenue per customer. This is your MRR (from #2) divided by the number of active users.

LTV : CAC ratio – finally, you divide your LTV by your CAC. If this is greater than one you are ready to scale up. You’re making a unit profit per customer and a certain level of scale this profit will cover your overheads and future development costs.

If it’s less than one you’re not yet ready to scale. You need to invest time and resources working on:

- Improving your product / market fit.

- Finding a more efficient marketing strategy.

- Improving your revenue model.

- Fine tuning your pricing strategy

Your LTV : CAC ratio is the single metric that’ll measure the effectiveness of your changes.

… Make your data count

Finally, there’s no point in making a huge effort to measure complex KPI’s unless you can use them effectively to make better decisions.

To be useful, data has to be timely. Tech businesses are insanely fast moving. Unless you’re looking at current data you’re wasting your time. The KPI’s that matter aren’t easy to calculate and involve collecting a lot of data, both financial and non financial. It’s vital that you have a finance operation that’s experienced in turning around performance analytics quickly and efficiently.

To be useful, data has to be impactful. Tech businesses are also chaotic, with founders being pulled in many directions.

- You need data to be focussing on a small number of highly tailored metrics that get to the heart of what your business needs to do to scale.

- More than this, you need them to be presented by someone who’s an expert in analysing them and drawing out the key insights.

P.S. whenever you’re ready …

Tech businesses aren’t like other businesses. We’re a boutique accounting, consulting and financial data analytics firm that specialises in helping tech businesses scale.

We hope you found this article useful. Whenever you’re ready, here are some more ways we can help:

#1 Get a complimentary copy of my book

#2 Join the programme

We provide clients with an integrated package of virtual CFO services, financial control and tax structuring and outsourced finance operations.

Whether you’re an early stage start-up or well into your scale-up journey we’ve tailored a package that provides the support you need right now (at a price you can afford) and helps you get to the next level. Jump on a quick 10 – 15 minute call to see how we could help you scale smarter.

#3 Work with me one-to-one

We have tried and tested methodologies that help you past common problems that tech businesses encounter. If you’re not ready to work with us on an ongoing basis but need some help on something specific these are ideal. Find out more about our workshops and bespoke one-to-one support.